Abstract

This paper tests whether the slope of the yield curve in emerging economies predicts inflation and growth. It also investigates whether the USA and euro area curves help to predict. It finds that the yield curve in emerging economies contains information for future inflation and growth, with differences across countries being seemingly linked to market liquidity. The US and euro area yield curves are also found to contain information for future inflation and growth in emerging economies. In particular, for those economies with exchange rates pegged to the US dollar, the US yield curve is often a better predictor than the domestic curves and causes their movements. This suggests that monetary policy changes in the USA are drivers of international financial linkages through base interest pass-through and the low end of the yield curve.

Similar content being viewed by others

Notes

The use of financial prices as business cycle indicators dates back as far as Burns and Mitchell (1935) who included both stock prices and interest rates in a list of leading economic indicators.

Bernanke (2006) concurs in saying that the inversion of the US yield curve of early 2006 is not necessarily a signal of a recession to come.

For instance, Hamao et al. (1990), King et al. (1994) as well as Lin et al. (1994), detect some spillovers from the US to Japanese and UK equity markets, both for returns and in particular for conditional volatility. Moreover, the seminal papers by Engle et al. (1990) and Andersen and Bollerslev (1998) find strong spillovers in foreign exchange markets. A recent contribution by Ehrmann et al. (2005) looks at money, bond, equity markets and exchange rates in the United States and euro area and also finds substantial international spillovers, both within and across asset classes.

Note that, due to limitations arising from the time span of my data (around 10 years), I discarded real GDP, which is available at the quarterly frequency only, as this would have left a small number of degrees of freedom.

The correction ensures that the covariance matrix is both consistent and positive semi-definite. An alternative specification is to use k lags of X in (1), possibly removing insignificant ones, although interpretation becomes more challenging. The selected specification has the advantage of readily providing an estimate of the response of future inflation and growth to past changes in the slope of the yield curve. The latter, which can be also used as a rule-of-thumb when taking the yield curve as a leading indicator, is of clearer relevance from a policy perspective.

A random-walk, the standard benchmark in forecasting competitions for exchange rate models, is not appropriate here. I find indeed that both output and prices are I(1) for my sample of countries. This suggests that growth and inflation are I(0), so that an AR process is a satisfactory proxy of the variables I attempt to forecast, with shocks having persistent, but not necessarily permanent effects.

I could not calculate the test statistics for 12-month and 18-month ahead forecasts, as these would produce too-small forecast error series, with 12 and 6 observations, respectively (see, e.g. Harvey et al. 1997, Table 1 p. 285, who do not report the results of their size tests on the standard Diebold–Mariano and their modified Diebold–Mariano statistics for forecasts 8 periods ahead and above and with less than 16 observations). Estimating the models with a shorter time period prior to out-of-sample forecasting is not an ideal solution, as this would likely result in inconsistent estimates, especially for those countries whose data sample starts fairly late in the 1990s and barely spans a full business cycle.

I also take German rates as a proxy for euro area rates, both at the long and the short end of the yield curve. Admittedly, since the advent of the euro, the money market swap rate has increasingly gained benchmark status at the short end of the maturity spectrum. However, it is available only since 1999 only, which would have obliged me to discard the earlier part of the sample. Clearly, this is highly unlikely to bias my results, as the 3-month Treasury bill rate is a very close substitute for it (with a correlation coefficient of 0.98 post-1999).

It is this (country-specific) lag length which is retained in the subsequent estimations (Stock and Watson 2003, use a fixed—i.e. country non-specific—lag length of 4). I also keep the seasonal dummies and the dummies to control for outliers and crises (the dummy equals 1 in November 2000 for Philippines; from September 1998 to December 1998 for Mexico; May 1998 to June 1998 for Malaysia; January 1998 to April 1998 for Korea; and 0 otherwise).

Results are not reported here to save space but are available upon request.

In other words, a regression for 14 countries × 24 (k) lags × 24 (h) months, for both inflation and industrial production growth, given the chosen parameterisation (as explained below).

Clearly, an alternative would be to pool the data and use a panel estimator. However, this (1) would make the results not comparable with the previous literature, for which country-by-country estimates is the standard; (2) is not needed, as the number of observations available per country (around 80 to 120) is already sufficient for efficient estimation and (3) would likely lead to biased estimates towards emerging Asian coefficients (as emerging Asian economies account for half of the countries in the sample).

Taiwan is an exception, as predictive content for forecast horizons above a year and half is found not to be significant.

Malaysia is an exception, as predictive content for forecast horizons below two years is found not to be significant. Predictive content for some forecast horizons is also found not to be significant for India, Philippines and Taiwan. Saudi Arabia had to be dropped from the sample as it has time series for oil production only, not for total industrial production.

As data for Brazil were available for a short time period (since 2000 only), constraining the number of degrees of freedom, out-of-sample forecasting could be performed at the 6-month horizon only.

To give an idea of the intensiveness of the computations involved, this adds another 16,000 regressions to the previous estimations.

For some of these countries, the ability of the US yield curve to predict inflation or growth likely stems from the greater liquidity of US debt security markets, and thereby more efficient information processing in forecasting common shocks.

Results are not reported here to save space but are available in the working paper version of the paper and upon request.

The modified DM-statistic is equal to the standard one times a scaling factor; it follows a t-distribution with n − 1 degrees of freedom.

Uribe and Yue (2006) find indeed that country spreads drive their business cycles and play a role in propagating US interest rate shocks.

It is worth noting that the overall share of domestic debt securities in GDP is not a good proxy for liquidity, as it includes—in economies which had high and volatile inflation—instruments that are linked to a foreign currency or indexed to prices.

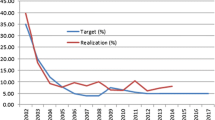

The index is constructed from Reinhart and Rogoff (2004)’s de facto classification of exchange rate regimes. Each country is split each year into 3 categories, i.e. peg, intermediate and float, with weights of 0, 1 and 2, respectively. I take the weighted average over the sample period as a proxy of the de facto regime of the corresponding country. The proxy is therefore continuously increasing with exchange rate flexibility.

References

Andersen TG, Bollerslev T (1998) Deutsche mark-dollar volatility: iontraday activity patterns, macroeconomic announcements, and longer run dependencies. J Financ 53:219–265

Ang A, Piazzesi M, Wie M (2006) What does the yield curve tell us about GDP growth? J Econometrics 13:359–403

Arnwine N (2004) The fisher equation and output growth, mimeo, Bilkent University. http://www.bilkent.edu.tr/~economics/papers/04–08%20DP_Arnwine.pdf

Bernard H, Gerlach S (1998) Does the term structure predict recessions? The international evidence. Int J Financ Econ 3:195–215

Bernanke B (2006) Reflections on the yield curve and monetary policy, remarks before the economic club of New York, Federal Reserve Board, 20 March 2006

Bernanke B, Blinder A (1992) The federal funds rate and the channels of monetary transmission. Am Econ Rev 82(4):901–921

Bernanke B, Mishkin F (1992) The predictive power of interest rate spreads: evidence from six industrialized countries. Mimeo, Princeton University

Bonser-Neal C, Morley T (1997) Does the yield spread predict real economic activity? A multicountry analysis. Federal Reserve Bank Kansas City Econ Rev 82(3):37–53

Burns A, Mitchell W (1935) The National Bureau’s measures of cyclical behaviour, NBER Bulletin, 57

Chinn M, Frankel J (2005) The euro area and world interest rates. Mimeo. Harvard University and University of Wisconsin (Madison), January 2005

Dickey D, Fuller W (1979) Distribution of the estimates for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Dickey D, Pantula S (1987) Determining the order of differencing in autoregressive processes. J Bus Econ Stat 15:455–461

Diebold F, Mariano R (1995) Comparing predictive accuracy. J Bus Econ Stat 13:253–263

Greenspan A (2005) Letter to the honourable Jim Saxton, Chairman of the Joint Economic Committee, 28 November 2005

Ehrmann M, Fratzscher M, Rigobon R (2005) Stocks, bonds, money markets and exchange rates—measuring international financial transmission. ECB Working Paper, No. 452, March 2005

Engle R, Ito T, Lin W (1990) Meteor-showers or heat waves—heteroskedastic intradaily volatility in the foreign exchange market. Econometrica 55:391–407

Estrella A (2005a) Why does the yield curve predict output and inflation? Federal Reserve Bank of New York, Mimeo, February 2005

Estrella A (2005b) The yield curve as a leading indicator: frequently asked questions. Federal Reserve Bank of New York, Mimeo, October 2005

Estrella A, Hardouvelis G (1991) The term structure as a predictor of real economic activity. J Finance 46(2):555–576

Estrella A, Mishkin F (1997) The predictive power of the term structure of interest rates in Europe and the United States: implications for the European Central Bank. Eur Econ Rev 41:1375–1401

Estrella A, Rodrigues A, Schich S (2003) How stable is the predictive power of the yield curve? evidence from Germany and the United States. Rev Econ Stat 85(3):629–644

Hamao Y, Masulis R, Ng V (1990) Correlations in price changes and volatility across international stock markets. Rev Financ Stud 3:281–307

Hardouvelis G, Malliaropulos D (2004) The yield spread as a symmetric predictor of output and inflation. CEPR Discussion Paper, No. 4314, March 2004

Harvey D, Leybourne S, Newbold P (1997) Testing the equality of prediction mean squared errors. Int J Forecast 13:281–291

International Monetary Fund (2002) Emerging local bond markets, global financial stability report. September 2002, Washington DC

International Monetary Fund (2003) Local securities and derivatives markets in emerging markets: selected policy issues. Global financial stability Report, March 2003, Washington DC

International Monetary Fund (2005) Global financial market developments, global financial stability report, April 2005, Washington DC

International Monetary Fund (2006) Structural changes in emerging sovereign debt and implications for financial stability, global financial stability report. April 2006, Washington DC

International Monetary and Financial Committee of the Board of Governors of the IMF (2006) Communiqué following its XIIIth meeting, Washington DC, 22 April 2006, http://www.imf.org/external/np/cm/2006/042206.htm

Frankel J, Schmukler S, Servén L (2004) Global transmission of interest rates: monetary independence and currency regime. J Int Money Financ 23:701–733

Jeanne O, Guscina A (2006) Government debt in emerging market countries: a new data set. IMF Working Paper, No. 6/98, April 2006

King M, Sentana E, Wadhwani S (1994) Volatility and links between national stock markets. Econometrica 62:901–934

Kozicki S (1997) Predicting real growth and inflation with the yield spread. Federal Reserve Bank Kansas City. Econ Rev 82:39–57

Jorion P, Mishkin F (1991) A multi-country comparison of term structure forecasts at long horizons. J Financ Econom 29:59–80

Lin W, Engle R, Ito T (1994) Do bulls and bears move across borders? International transmission of stock returns and volatility. Rev Financ Stud 7:507–538

Mishkin F (1990a) What does the term structure tell us about future inflation? J Monet Econ 25:77–95

Mishkin F (1990b) The information in the longer-maturity term structure about future inflation. Q J Econ 55:815–828

Mishkin F (1991) A multi-country study of the information in the term structure about future inflation. J Int Money Finance 10:2–22

Mehl A, Reynaud J (2005) The determinants of ‘domestic’ original sin in emerging market economies. ECB Working Paper, No. 560, December 2005

Newey W, West K (1987) A simple positive, semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55:703–708

Shambaugh J (2004) The effect of fixed exchange rates on monetary policy. Q J Econ 119(1):301–352

Obstfeld M, Shambaugh J, Taylor A (2005) The trilemma in history: tradeoffs among exchange rates, monetary policies, and capital mobility. Rev Econ Stat 87(3):423–438

Plosser C, Rouwenhorst K (1994) International term structures and real economic growth. J Monet Econ 33:133–155

Reinhart C, Rogoff K (2004) The modern history of exchange rate arrangements: a reinterpretation. Q J Econ 119(1):1–48

Stock J, Watson M (2003) Forecasting output and inflation: the role of asset prices. J Econ Lit 41:788–829

Uribe M, Yue V (2006) Country spreads and emerging countries: who drives whom? J Int Econ 69:d6–36

Werner T (2006) Term premia developments in the Euro area: an affine term structure model estimated with survey data. Mimeo. European Central Bank

Acknowledgement

The author is grateful to the editor, to an anonymous referee, to participants in the 4th Workshop on Emerging Markets organised by the Bank of Finland Institute for Economies in Transition on 21–22 September 2006, including Jesús Crespo Cuaresma and Iikka Korhonen, as well as to participants in an ECB internal seminar for comments. The author is also thankful to Oscar Calvo-Gonzalez, Michael Fidora, Marcel Fratzscher, Lucio Sarno and Christian Thimann for useful suggestions as well as to Thomas Werner for helpful discussions. The views expressed in the paper do not necessarily reflect those of the European Central Bank.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mehl, A. The Yield Curve as a Predictor and Emerging Economies. Open Econ Rev 20, 683–716 (2009). https://doi.org/10.1007/s11079-007-9077-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-007-9077-x